Introduction

2023 was a wild year for software developers. Layoffs and tech hiring slowdowns created a sense of economic uncertainty, while AI’s sudden leap to mainstream use is already disrupting how developers write code and how companies think about their skills strategies.

After such major upheaval, it’s only natural to

ask – what the heck is going on?

While we don’t have the answers to life, the universe, and everything, we are the leader in evaluating developer skills. Our unique position at the intersection of developer skills and hiring gives us a good idea of what’s going on with both, and what might lay ahead in 2024.

Executive Summary

Putting developer skills in context

For this year’s Developer Skills Report, we’re starting big, exploring trends across the entire industry, before narrowing focus to developer skills and ultimately to the developers themselves. From there, it’s a look forward to where developer skills are going, particularly around two topics that will drive a lot of skills demand over the next several years – upskilling and AI.

What’s going on with the industry?

While the first half of 2023 was lackluster, with lower hiring activity, the second half showed signs of stabilization and positive traction.

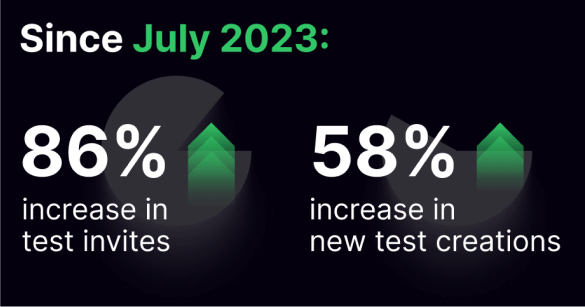

- From July 2023 forward, developer test invites and new test creations, both barometers of hiring activity, increased 86% and 58% respectively.

- 52% of developers remain concerned about layoffs, despite only 6% reporting being laid off themselves.

- 68% of survey respondents believe 2024 will be a better year.

What’s going on with developer skills?

Developer skills are constantly evolving to respond to new technologies, new applications, and new growth areas. The past year was no exception.

A rising tide does not lift all boats. While demand for many skills has come back, some, like Java and JavaScript, languish. College is losing relevance. 52% of developers don’t think it prepares students with the skills they need. Leaders think they understand their employees’ skills. Developers are less certain - only 38% agree.

What’s going on with developers?

Developers are so much more than their skills. It’s important for companies to understand their state of mind, their motivations, if they’re to attract and hold onto the right people for the right roles.

Executives, managers, and recruiters all believe developers value security over opportunity. But developers value opportunity more, 44% to 27%. Opportunity motivates developers pondering job changes more than perks or warm fuzzies. Team and culture won’t land candidates, but they’re a major factor in why developers stay.

What’s going on with upskilling?

Companies that invest in upskilling reap all kinds of benefits, from productivity to retention, but the perceptions and application of upskilling remain wildly inconsistent.

Developers are 3X more likely than their managers to say that upskilling isn’t offered at their company Only 22% of developers say they’re regularly given time for upskilling/learning. 48% have to find the time on their own.

What’s going on with AI?

AI took off in a big way in 2023, even amid a tech hiring hibernation. And we’re only at the beginning of the adoption curve.

New AI test creations are up 2.5X after July 2023. AI has already achieved mainstream adoption among developers - 76% report using ChatGPT for work. 3 in 4 survey respondents are concerned about AI-related plagiarism on technical assessments.

What’s going on in the industry?

Key insights

- Multiple signals indicate tech hiring moving in a more positive direction

- New test creations are up 58% since July 2023

- Test invites are up 86% since July 2023

- 52% of developers remain concerned about layoffs

- Nearly half of developers feel their industry is in a recession

- 68% of developers think conditions will be better in 2024

Signs of a stabilizing market

The end of 2022 and the first half of 2023 were dicey in the hiring market, and tech in particular.

However from July 2023 forward, we’ve seen several signals that things may be heading in a more positive direction.

Test invites are making a comeback

The first signal that things may be looking up? Test invite data. Test invites are sent to candidates and make a useful barometer of hiring activity. If companies aren’t interviewing, they aren’t sending out test invites, and vice versa.

In the current cycle, we observed the first signals of declining test invites in mid-2022. Toward the end of the year, they declined further and stayed persistently lower through June 2023. Starting in July 2023, test invites are rebounding.

Over the four months from July-October 2023, invites are up by 86%.

Recruiters are creating tests again

Second? New test creations. New tests may be created to support hiring for a new role, to replace old tests, or to assess skills in newer technologies or certain specializations. Taken as a whole, they can be indicative of coming hiring activity or evolving skill requirements.

Looking back to 2022, the sharp decline toward the end of the year stands out, as does the equally sharp increase that kicked off in July 2023.

From July forward, new test creations are up 58%.

External sources show similar patterns

Our findings are echoed in other market sources. As of its October 2023 release, Challenger, Gray & Christmas notes that 2023 is on track for the most tech sector layoffs on record. However, those layoffs tapered off in June, about the time we began seeing signs of renewed hiring activity.

Likewise, US corporate profits revived in the third quarter, according to the US Bureau of Economic Analysis, in a chart that looks quite similar to our test invite data.

Layoff concerns linger

Tech layoffs made headlines throughout the last half of 2022 and into 2023, and 52% of developers are understandably concerned.

However, only 6% say they’ve been laid off in the last two years.

Generally, developers are less vulnerable to layoffs compared to other disciplines, but there is plenty of anecdotal data from friends, coworkers, and social feeds to stoke anxieties regardless.

Schrodinger’s recession

Are we in a recession? That’s for the economists to sort out, but…

48% of developers feel like their industry is in a recession. Even if things are going well, for many it doesn’t feel like it.

This may be due to several factors. There’s the macroeconomic definition of recession, and then there’s the vibe of recession. Sweeping layoffs, reduced hiring, higher prices, belt-tightening and budget cuts, even return to office mandates can contribute to a sense that things aren’t great.

Developers are most likely to feel recession vibes

Compared to other disciplines, developers are slightly more pessimistic about the current state of their industry. One possible factor could be the relative exposure of developers to layoffs in 2023, where in the past they've been more insulated from staff reductions and reorgs.

Ironically, talent acquisition professionals, who have been among the most impacted groups in recent waves of layoffs, are also the most optimistic about the state of their industry.

Better times ahead?

Looking to this year, respondents were broadly optimistic.

68% predict better conditions ahead in 2024.

Another 25% think things will stay about the same, and less than 8% believe conditions will deteriorate.

What’s going on with developer skills?

Key insights

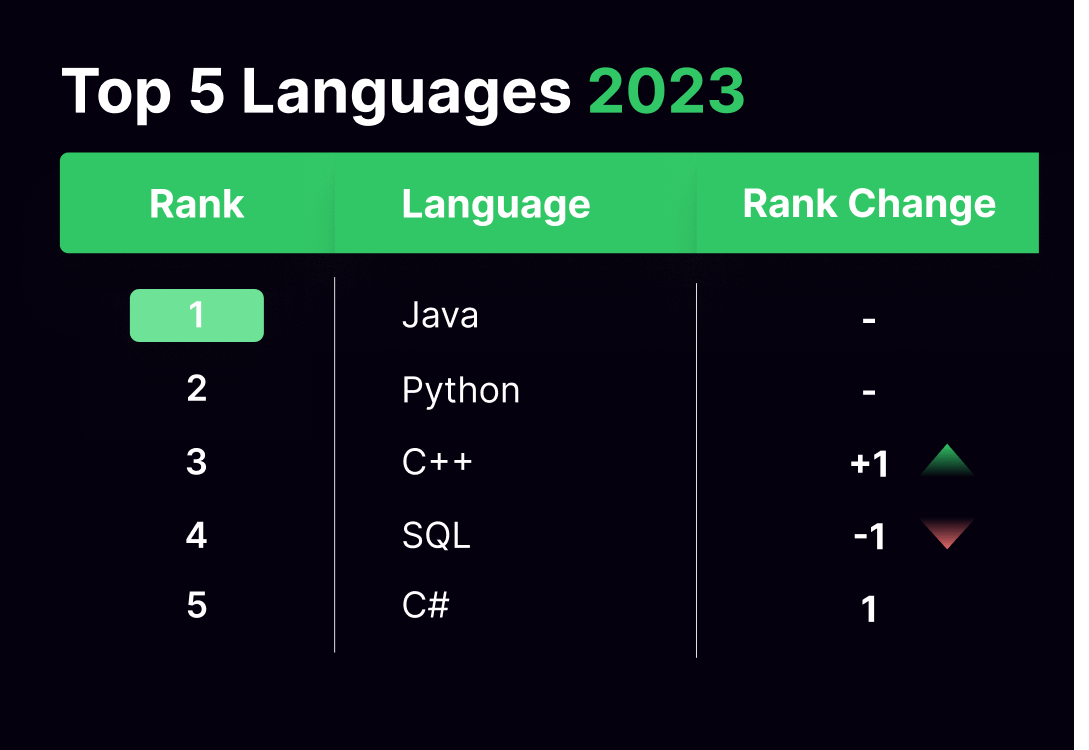

- Java and Python remain the top languages recruiters are looking for, though the distance between them narrowed significantly in 2023.

- More than half of developers (and 49% of students) say college is not preparing students with the skills they need to thrive.

- The college requirement is changing. 60% of developers (and nearly half of recruiters) don’t think a college degree is necessary for technical roles. What matters is the skills.

- Managers and execs think they have an accurate understanding of their employees’ skills. Developers are less certain - only 38% of them agree.

We’ve adjusted how we measure demand for languages and skills. For this year’s report, we are basing recruiter demand on new test creations that either include the skill in the title, or feature specific questions flagged by our data team as being indicative of certain skills.

This method helps us zero in on which skills recruiters (and thus companies) are specifically looking for. However, it can also obscure certain fundamental skills that are assumed and thus not tested for specifically. JavaScript, for example, ranked sixth in new test creations in 2023. All that means is that recruiters are not creating as many tests specifically evaluating JavaScript proficiency.

Python is closing on Java

In 2023, demand for most languages declined compared to 2022. And that decrease is largely explained by lower activity throughout the first half of 2023.

While rankings remained mostly unchanged, we did notice some interesting trends that could impact demand in the coming year.

Java remained the most in-demand language of 2023, but monthly average test creations slid by 47%. This allowed Python, one of the major languages to actually increase demand in 2023, to close some distance.

In 2022, Python's test creations were just 32% of Java's. In 2023, they accounted for 74%. If this pattern holds throughout 2024, Python may overtake Java. Given Python's close association to AI, that's entirely possible.

AI skills came alive in the third quarter

We didn’t see any significant trading of places among skills. The top three skills recruiters look for stayed the same from 2022 to 2023.

The same basic pattern observed elsewhere – everything shuffling back to life in July – holds for skills, too.

For example, creations of new tests measuring AI and machine learning-related skills took off like a rocket starting in July 2023, and October was the highest month on record for AI-related test creations.

The perceived value of college is being questioned

Looking ahead to the next generation of developers – are colleges preparing graduates with the skills they need to thrive in modern workplaces? By significant margins, survey respondents are more likely to say no.

Developers and executives are the least likely to agree, with net sentiments of -24 and -28, respectively.

Recruiters are the only group to agree more than disagree, at 38% to 30%, or +8 sentiment.

Even students are questioning the value of college – only 31% believe it’s preparing them for work.

Only 27% of developers think college is preparing graduates with the skills they need to thrive in the modern workplace

College is no longer seen as a prerequisite for technical roles

This erosion in the perceived value of college also shows up in people’s attitudes about degrees as prerequisites for technical roles.

60% of developers do not think degrees should be prerequisites for tech jobs, along with 53% of executives and 49% of recruiters.

Recruiters were the most likely to support degree prerequisites, at 22%.

In a fascinating twist, current students are the most eager to ditch the degree prerequisite (67%).

What does this mean?

We’ve always championed skills over pedigree, and it’s heartening to see individual opinions shifting in that direction. But overcoming decades of corporate inertia will take time.

Leaders think they have a pulse on developer skills…but do they?

60% of executives and 61% of engineering managers say they have an accurate understanding of their employees’ skills.

But when we turned the tables and asked developers, only 38% said their company has an accurate understanding of their skills.

What does this mean?

Leaders are significantly more confident in their understanding of developer skills than their developers are. But is this a case of overestimation or undercommunication? Or both?

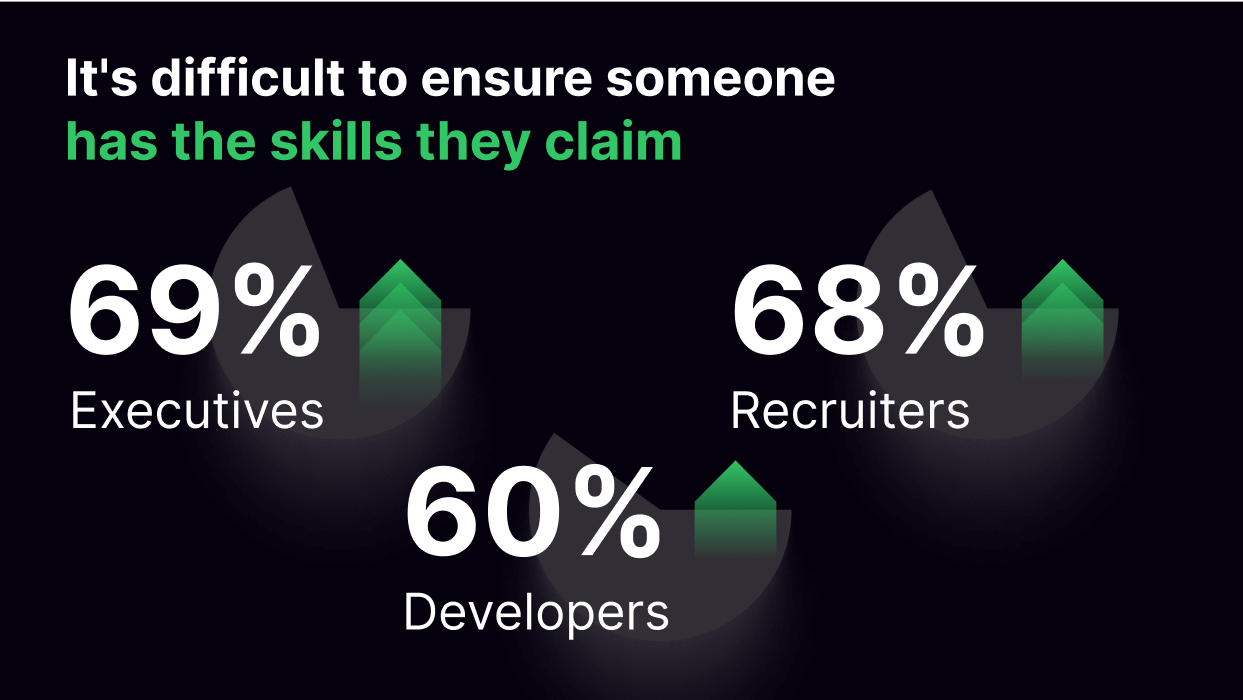

Assessing skills is, like, really hard

It’s hard to ensure people actually have the technical skills they say they do. Strong majorities of our survey respondents agree, including 68% of recruiters and 69% of executives.

60% of developers also agree it’s a challenge. While a majority, it’s a notably lower majority. And 26% of developers don’t think ensuring skills is hard at all. One possible factor? Being more hands-on may give them an edge distinguishing between competence and embellishment.

Or, in a more casual parlance, game recognizes game.

Pro tip: Assessing technical skills – and having confidence in your findings – is critical for any company to hire, upskill, and promote their developers.

What’s going on with developer skills?

Key insights

- Top roles remain focused in back-end and data

- Developers value opportunity over security

- When considering job changes, developers are more motivated by opportunity than by perks or warm fuzzies

- Team and culture are second tier concerns for joining a company, but a big factor in why people stay

Developers are opportunity-minded

In the current economic climate, managers, leaders, and recruiters all say developers value security more than opportunity, by about 40% to 33%.

Developers disagree.

44% to 27%, developers place more importance on opportunity. More developers waffled and selected both/neither than selected security.

What does this mean?

Don’t get complacent. Developers aren’t hunkered down, grateful just to have a job. They will move on if the right opportunity presents itself.

Should devs stay or should they go?

What does the right opportunity look like? What factors motivate developers to accept a new job, stay in a current one, or walk away from the offer table?

We asked developers to rank the incentives that would attract them to a new role or new company.

While higher pay takes the number one spot – over 21% of developers ranked it first among the factors likely to attract them to a new role – career and learning opportunities were not far behind.

Pro tip: Investing in skill development yields more than just productivity and competency gains – it also boosts recruitment and retention.

Why do developers stay?

We also asked developers what’s keeping them in their current position. Many factors carry over, but they are not exactly the same as the ones leading them elsewhere.

Growth opportunities – in both skills and career – are significant motivators not only for attracting skilled developers, but also holding on to them.

Team and culture track significantly higher, too. While they may not be on the top shelf of factors attracting developers to new opportunities, they absolutely play a role in retention.

Pro tip: Don't neglect culture in stressful times.

It’s a key reason people stay.

Recruiters and developers have differing ideas of what developers want

We also checked in with talent acquisition professionals about what’s attracting candidates, and what are proving to be dealbreakers.

Recruiters place team and culture right at the top, at odds with how developers are ranking attractors. Likewise, the top motivator for developers to move – higher pay – is way down the list.

There’s a clear gap here between what developers say motivates them, and what talent acquisition believes motivates them. And that shows up in talent acquisition’s ranking of factors that prove to be dealbreakers for candidates.

Pay is far and away the biggest dealbreaker, followed by in-office policy. Both of which rank very low in talent acquisition’s list of attractors.

Pro tip: Lean into growth opportunities, interesting projects, and flexibility as key parts of your pitch. Or, you know, higher salaries.

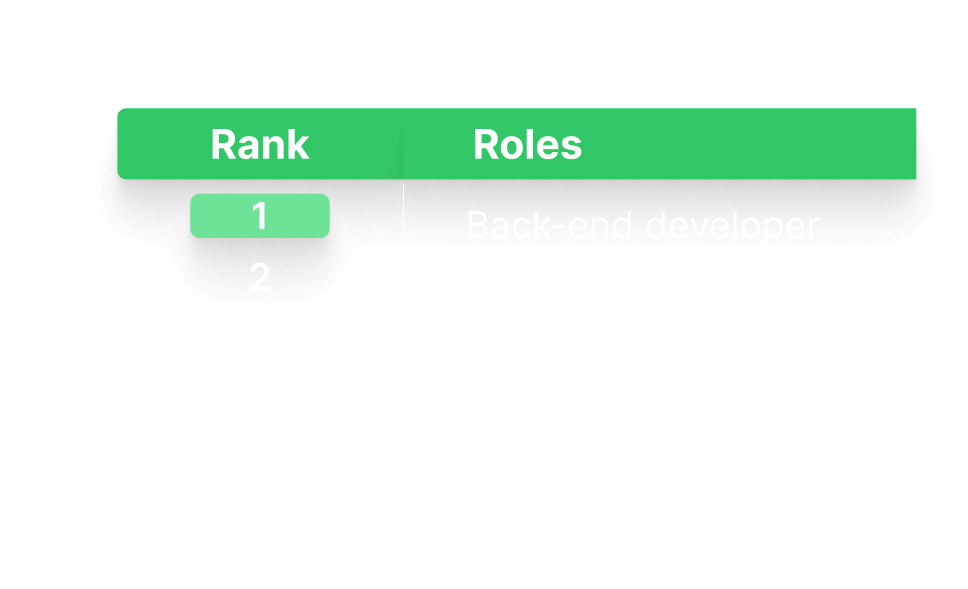

The world needs (a ton of) back-end developers

Let’s turn to specific roles. By filtering invites based on job title and job description, HackerRank has in-depth information about which roles companies are looking for.

For 2023, the top roles by total invites are about what you’d expect. Back-end and front-end developers lead the pack by a significant amount.

Back-end devs received more total invites than the next four roles combined

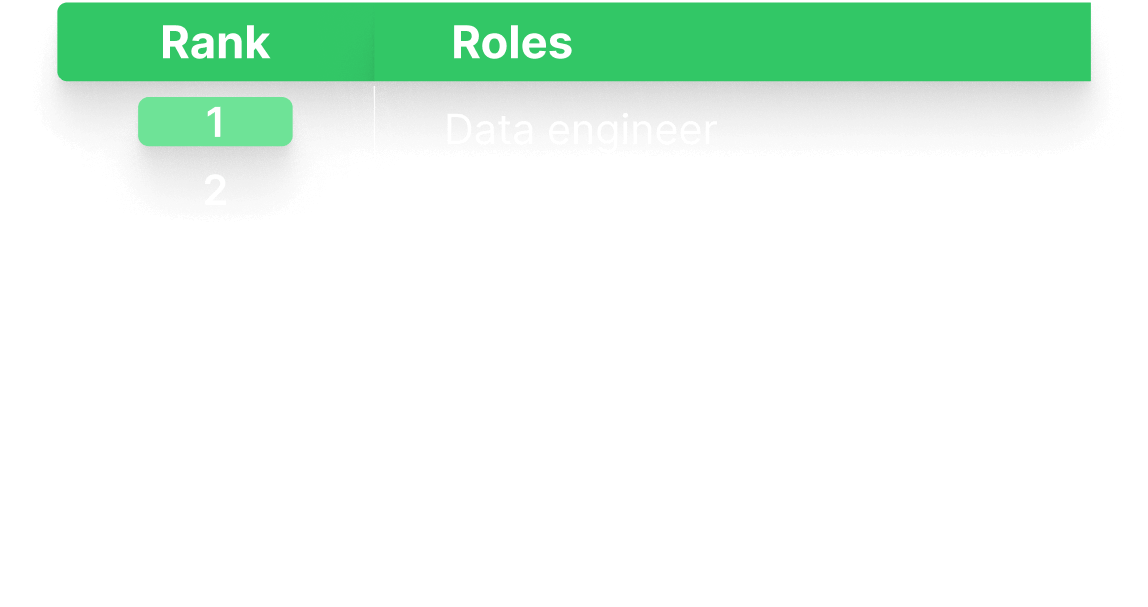

Data and cloudsec roles have proven resilient

Volume isn’t everything, and many roles have seen their demand shift wildly since mid-2022.

While demand for some roles has plunged, the roles to the right have sustained the steadiest demand since the summer of 2022. Average monthly invites for data engineering roles actually increased by 102% from their 2022 highs.

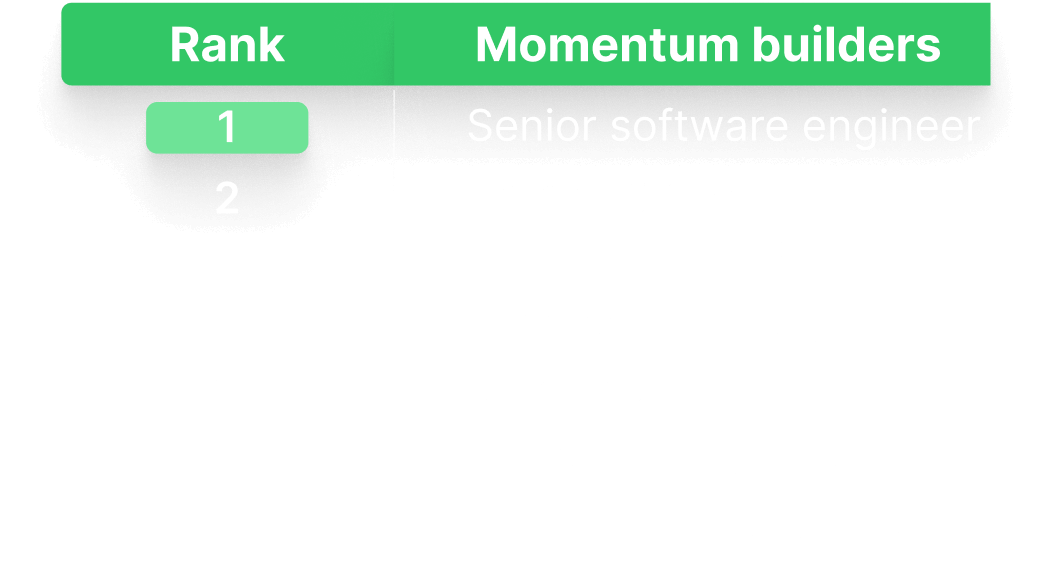

Demand surged for numerous roles in late 2023

Other roles suffered low demand through much of 2023, but started to rally in July. These five roles have all seen demand surge.

Some niche roles have seen faster growth, but likely suffer from base effects, where low volumes translate to outsized growth. For this list, we’ve put a lower bound at 250 average monthly invites.

What’s going on with upskilling?

Key insights

- Developers are the most likely to say their company doesn’t offer upskilling (20%)

- Nearly half of developers have to make their own time to take advantage of upskilling options

- Developers prefer learning new skills in the context of work projects

- 72% of developers say upskilling works or mostly works

- Recruiters and executives are the most favorable to “old school” upskilling options

Offered and tracked

72% of developers say their company offers some form of structured or unstructured upskilling opportunities. This is out of step with the 84% of engineering managers who say the same.

The difference lies in unstructured upskilling – 44% of managers say it’s offered compared to just 31% of developers.

Developers aren't as aware of learning opportunities

Compared to other respondents, developers are the least likely to answer affirmative to unstructured upskilling and the most likely to answer that upskilling is not offered.

Clearly there's a perception gap. Getting to the exact cause will require additional research, but one factor may be how effectively upskilling offerings are reinforced and encouraged to front line developers.

Many developers don’t get time for upskilling

Only 22% of developers say they’re given time for learning/upskilling. 28% are sometimes given time. 48% – nearly half – say they have to make the time on their own.

This doesn’t match other perceptions. Only 32% of engineering managers and, 33% of execs, 28% of talent acquisition think developers have to make their own time.

Talent acquisition is also the most likely group to say the company provides learning time. This may be due to the more outward-facing role, walking through incentives with prospects and candidates, while the reality of the day to day can be something different.

Pro tip: Ensure your skills strategy and upskilling initiatives are making it to the developers actually doing the work.

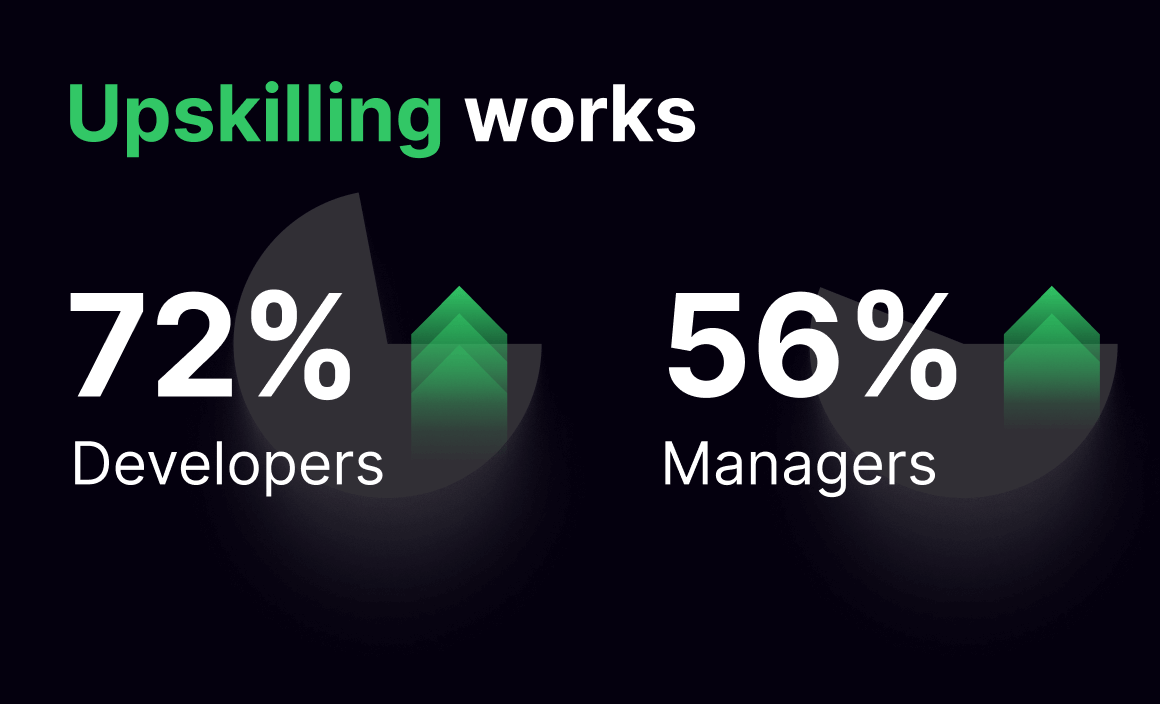

Does upskilling work?

Overall, survey respondents agree that upskilling works or mostly works, though the rates varied.

Developers are the most favorable - 72% say upskilling works or mostly works.

Engineering managers are the most skeptical – only 56% say upskilling works or mostly works. 37% say it sometimes does, sometimes doesn't. But don’t confuse skepticism with pessimism. Only 7% of managers say upskilling doesn’t work.

Devs prefer learning as part of work

Overwhelmingly, developers prefer to learn new skills in the context of a work project. Other professionals agree - from engineering managers to TA to execs.

When tying learning to work projects isn’t feasible, developers prefer structured online learning, followed by self-directed online learning.

Bootcamps and team-based programs are generally less popular

As recently as a few years ago, bootcamps and in-person trainings were the gold standard for skills development. That’s no longer the case. Developers were not enthusiastic about team-based or in-person learning.

Neither are executives, which may be more pertinent, since they would have ultimate say over which learning methods a company embraces.

What’s going on with AI?

Key insights

- AI tools are already in common use across tech and non-tech roles

- 76% of developers use ChatGPT, 35% use GitHub Copilot

- New test creations for AI-related skills surged 2.5X in 2023

- 47% of devs approve of using AI assistants in tech assessments, compared to just 18% of recruiters.

- 84% of talent acquisition professionals are concerned about plagiarism

AI (well, ChatGPT) is already in mainstream use

ChatGPT is barely a year old, and it’s already hit mainstream use. Fully 76% of developers use ChatGPT for work. That’s up from 55% in a separate survey we conducted earlier in 2023.

35% use GitHub Copilot, and after that, we drop into the AI long tail. It’s telling that the third most-used AI tool is not using AI at all.

Developers aren’t the only ones using AI tools for work – everyone is, including 71% of executives and 64% of recruiters.

Executive use of AI tools was curiously high, particularly the longer tail offerings like Amazon CodeWhisperer. This could be due to the likelihood of having more technically-inclined executives – CTOs, CIOs etc – among our respondents.

What does this mean?

AI is here. It’s happening. It’s becoming a part of the professional skillset. The companies that embrace it and adapt their stance and their hiring processes to responsibly integrate AI tools will be better positioned for the future than those sticking their heads in the proverbial sand.

Welcome to the AI age

After the initial flurry of interest and hot takes, we saw businesses start evolving their skills strategies to cover AI, leading to a surge in new tests assessing AI and AI-related skills. While new test creations decreased an average of 24% across all skills from Q4 2022 through Q3 2023, new AI skills tests increased 58%.

Looking at just the three most recent months measured, new AI test creations are up 2.5x year over year.

We’ve also seen a sharp uptake of Large Language Model (LLM) test creations, which essentially do not exist before July 2023. To be clear, these are tests that use LLM in the title or that feature certain LLM-related questions identified by our data team. They are not tests in which developers use LLMs to generate code snippets.

Everyone’s mostly okay with recruiters using AI tools

Survey respondents broadly support recruiters using AI tools to streamline the interview and hiring process, including 77% of executives and 66% of developers.

Net favorability among all respondents is +46.

It’s worth noting that developers were less enthusiastic than other groups, and significantly more likely to disapprove (27%)

AI-powered plagiarism is a major concern

While talent acquisition is the most concerned about AI-powered plagiarism (84%), they're not alone.

3 in 4 survey respondents are some level of concerned.

Curiously, engineering managers are the least concerned (70%), and also the most likely to say they're unconcerned (20%).

Perhaps this is due to managers' familiarity with AI's use as a coding assistant and legitimate job aid, where recruiters may be more likely to see it as cheating.

Opinions are divided on AI in assessments

47% of developers approve of using AI assistants in assessments and net favorability (approve minus disapprove) is +18. Engineering managers are generally inverse, with a net favorability of -11. The most likely to disapprove? Recruiters, at -32. Half of them disapprove, compared to just 18% who do approve.

Executives, curiously, are split exactly 50/50 on the use of AI in assessments.

Methodology

The 2024 Developer Skills Report relies on two exclusive sets of data:

HackerRank Platform Data

Data extracted from the HackerRank platform. HackerRank collects millions of data points in a given year, and careful analysis can yield powerful insights into developer and organizational behavior. Surveys can help us understand what people are thinking and feeling - platform data reveals what they actually do. For this year’s report, we looked at a number of different metrics, including overall test invites, attempt rate, new test creations, languages used to answer questions, and more.

Developer Skills Survey

The Developer Skills Survey was conducted among the HackerRank community in the autumn of 2023. In total, 4,107 developers, engineering managers, talent acquisition professionals, executives, and students completed the survey. Due to the nature of the survey, the number of responses to specific questions may vary. Some questions, for example, were directed only at developers, others only at managers, and so on.

You're viewing a limited version of this report.

Fill out the form to see all insights.

(We'll also send you a PDF copy of the report via email.)

By submitting this form, you agree to our privacy policy.

Don't worry: we'll never sell or share your data with a third party.

Skills speak louder than words

We help candidates sharpen their tech skills and pursue opportunities.

We help companies develop the strongest tech teams around.